3 edibles that are beneficial for oral health

Morning routines are ingrained in our systems—waking up, turning on the coffee/tea machine, brushing teeth, eating breakfast, and so on. The coffee/tea is then accompanied by a range of choices— books, news, or the ever-present phone. But here is our question: while we have been at it for ages, how good a shape are our mouth and teeth in? And what can we do to make it better?

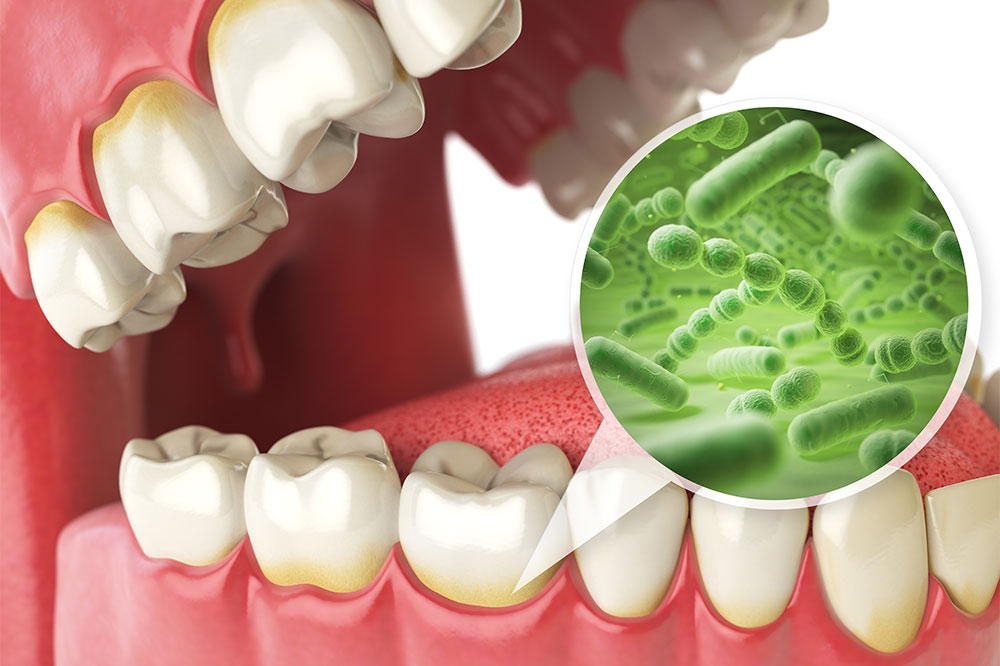

Our mouth is home to about a billion different bacteria. These microorganisms that live inside our oral cavities can prove to be dangerous to the mouth and teeth. That is exactly why parents around the world keep reminding their kids to brush their teeth before getting into bed as well. The last time we learned how to brush our teeth was when we were toddlers and we more or less know how to go about it. But how often do we floss? It’s important to remember that flossing is just as important as brushing.

The best means of maintaining impeccable oral health is by keeping your mouth and teeth food-free. Sugar acts as a storehouse of bacteria in our mouth and teeth. Similarly, there is a range of food products or ingredients that help in maintaining oral health. We enlist three of them:

- Chewing gum

The process of chewing stimulates the production of saliva, which, in turn, rids the mouth and teeth of the harmful acids the residing bacteria produce. Saliva also consists of calcium and phosphates, which result in the strengthening of the teeth. Chewing on a strip of gum can provide you with these benefits, but there is a catch. You can’t pick a random bubble gum from the supermarket aisle. To reap all the benefits of a chewing gum, you need to carefully select one that is sugar-free.

Some sugar-free gums contain an artificial sweetener called xylitol, a chemical compound that helps in killing oral bacteria. This means that chewing gums help you exercise and cleanse your mouth and also get rid of bad breath.

- Cheese

Cheese, a dairy product, is quite beneficial for the mouth and teeth. The high levels of phosphate and calcium that it contains help strengthen the teeth. Apart from providing strength, cheese also regulates and maintains the pH levels in our mouths. Balanced pH levels have benefits such as decreased levels of harmful acid production, cleaner salivary secretion, and lesser cavities.

- Water

Saliva washes the excess sugars and acids in the mouth and teeth. This provides protection against plaque and cavities. Similarly, water rids the mouth and teeth of the unwanted, harmful build-up of germs. Water also contains fluoride, a chemical that is present in toothpastes and mouthwashes, which strengthens the tooth enamel.

While these edibles may be beneficial for good oral health, it is important to be aware of the options that help in teeth straightening. Smile Direct Club offers teeth straightening kits for that perfect smile you have always wanted. Smile Direct Club does that by giving you a returnable impression kit by taking a 3D scan of your teeth and creating an Invisalign with a customized teeth alignment plan.