8 Essential grooming habits that men should follow

The concept of style has more to it than just wearing a fancy suit, a tie, and a pair of shoes. No matter what outfit you try on, the finer details truly matter. Maintaining healthy grooming habits is important whether you are indoors or you are traveling somewhere. You can ensure that your dressing style matches your personality by following certain self-care routines. Therefore, here are eight grooming tips one can follow daily.

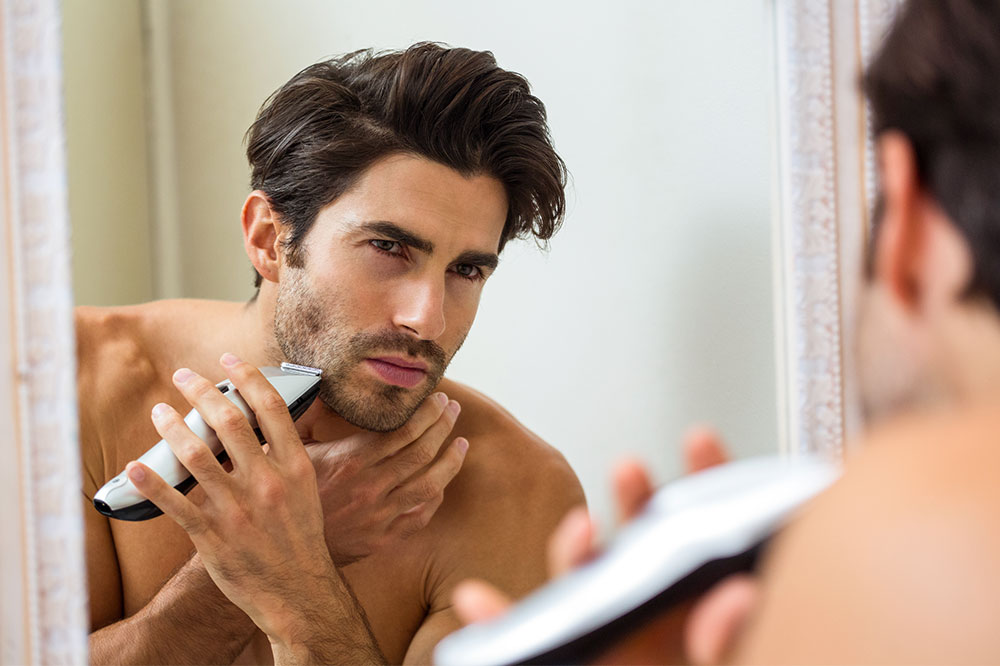

Regular trimming

Whether it’s the hair inside the nose, the eyebrows, or the beard, it is necessary to ensure these regions are trimmed regularly. Several popular brands offer a range of grooming essentials dedicated to each part of your body that can help get the job done efficiently and in the privacy of your home. Removing hair on the neck and near the ears regularly can also help improve your grooming game.

Matching belts to shoes

This is one of the easiest grooming tips ever. When you wear black shoes, do not wear a brown belt. Instead, wear belts and shoes of matching colors to boost your overall appearance.

Clipping nails regularly

The sight of long uneven nails is just as unappealing as the dirt and debris that may gather under them. To manage this, all you have to do is clip and file your nails regularly. If your budget permits, you could also go to a salon for a manicure or pedicure. Furthermore, buffing the nails can help maintain their shine without an artificial look.

Brushing and flossing teeth

An individual’s teeth may not always be straight or white, but keeping them clean is very important. It isn’t always a good sight to see food particles or plaque stuck on someone’s teeth when another individual speaks to them. Moreover, bad breath can bring down one’s overall personality. Therefore, as part of your grooming routine, you must brush and floss your teeth regularly.

Keeping good posture

Maintaining healthy grooming habits to complement your personality can include something as simple as standing up straight always. A good posture is always an indicator of confidence and pride, which is ideal for creating an excellent first impression in your social group.

Using facial soap

Several people apply the same soap on their faces that they use on their bodies. However, body soaps might be too strong for the face and can sometimes lead to skin complications. Therefore, it is best to use dedicated facial cleansers to keep the skin looking fresh using mild ingredients.

Applying the right amount of fragrance

Wearing perfume when you go outdoors is a healthy grooming habit. However, it is important to apply perfumes or deodorants only in small amounts and choose one brand that works best for you. Do not apply too much deodorant or perfume, as the fragrance might become excessively strong for another person to bear.

Taking warm showers

The hair has essential oils which can strip away when you have hot water baths. The lack of such oils can eventually lead to a dry scalp. Therefore, you must switch to warm water baths and limit showers to about ten minutes. Getting into this habit will help retain the essential oils in your hair and give it a healthy and shiny look.